As I sought direction in retirement planning, I found myself often bouncing between calculators and projections and forced to stitch them together mentally. After the nth time of this I decided to build my own product to make retirement planning simple.

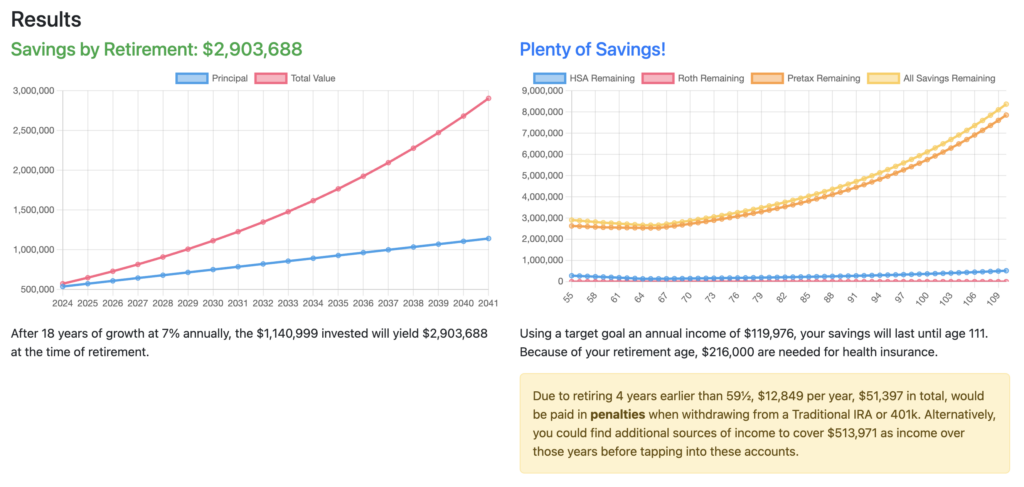

Introducing Retire Clearly, a one-stop planning tool intended to inform and direct retirement planners. After injecting your inputs (age, amounts saved, planned contributions, etc), this tool will offer a projection of the total amount saved for retirement by your planned retirement age. It will also demonstrate a withdraw strategy to optimize taxes and protect gains. You don’t want to be 15 years into retirement and run out of money! It is also important to be prepared for taxes and potential penalties for early withdraws.

How should I use this tool?

The best way to use Retire Clearly is to input your information and see what the future outcome may be based on your current strategy. Then, if you’re not arriving at retirement in the way you expect, you can adjust your contributions or retirement age to understand how you could arrive at retirement with enough savings to enjoy retirement for as long as you need!

How does it all work?

When Retire Clearly runs, it begins with calculating the projected savings you will have at retirement age. It uses compounding annual growth, conservatively not include contributions from the year, and ultimately merging pre-tax, post-tax, and HSA totals for clear visualizations.

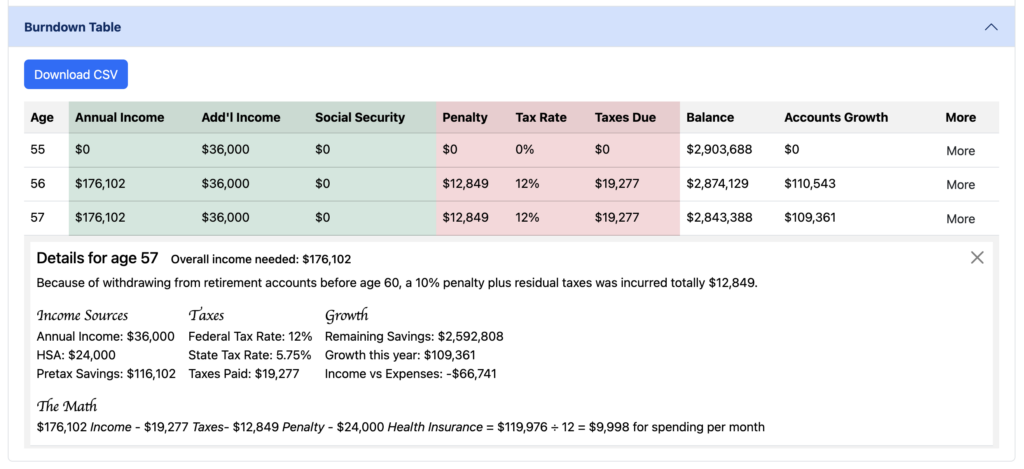

Retire Clearly then begins to “burndown” the savings, taking the amount needed per year and growing the remaining savings annually. The amount needed to withdraw varies annually due to:

- New income sources becoming available (Social Security, HSA)

- Tax deductions as a senior

- Potential penalties for withdraws before age 59½

- Tax implications from variably amounts of withdraws by pre-tax and post-tax accounts

The calculations use current federal and state taxes, as well as 2024-based social security, medicare, and retirement account laws.

Using Retire Clearly, you can see a breakdown of your income sources as well as total planned expenses. The math is laid out in the burndown table.

Is my retirement information private?

Retire Clearly is built to run purely in your browser. Any information you enter is held only on the browser you are using and it never leaves there. You can chose to store your inputs in a cookie in the browser, which will make future planning easier.